Maintaining the peg

Arbitrage oportunities

Last updated

Arbitrage oportunities

Last updated

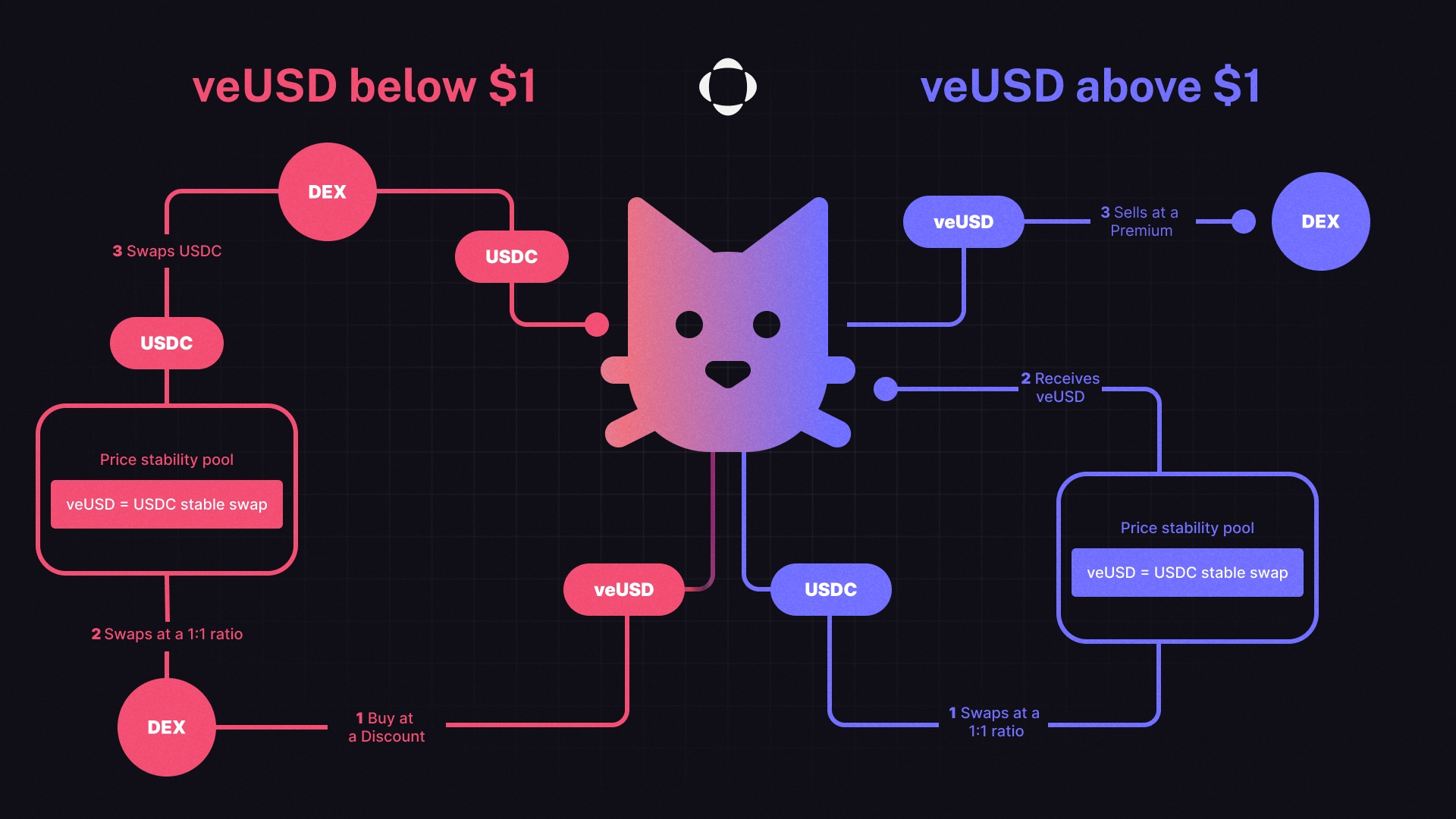

In case of de-pegging, veUSD has two mechanisms to restore the peg. Depending on whether the peg is lost to the upside or downside, users can profit from this situation through arbitrage opportunities.

veUSD Above $1: In this scenario, users can mint veUSD at a 1:1 ratio with stablecoins (such as USDC/USDT) and sell the veUSD on a DEX. For example, if 1 veUSD = $1.10 USDT, a user can deposit an equivalent amount of USDT on Vaultedge to mint the same amount of veUSD at a 1:1 ratio. The user can then sell the veUSD on a DEX for a 10% profit in USDT and use the USDT to repay the debt.

veUSD Below $1: In the event of veUSD de-pegging, users can buy veUSD at a discount on the open market (DEX) and then redeems collateral from the protocol vault at a higher price, resulting in a profit. When a user performs arbitrage following this mechanism, the veUSD is burned, reducing the supply and helping to bring veUSD back to its peg.