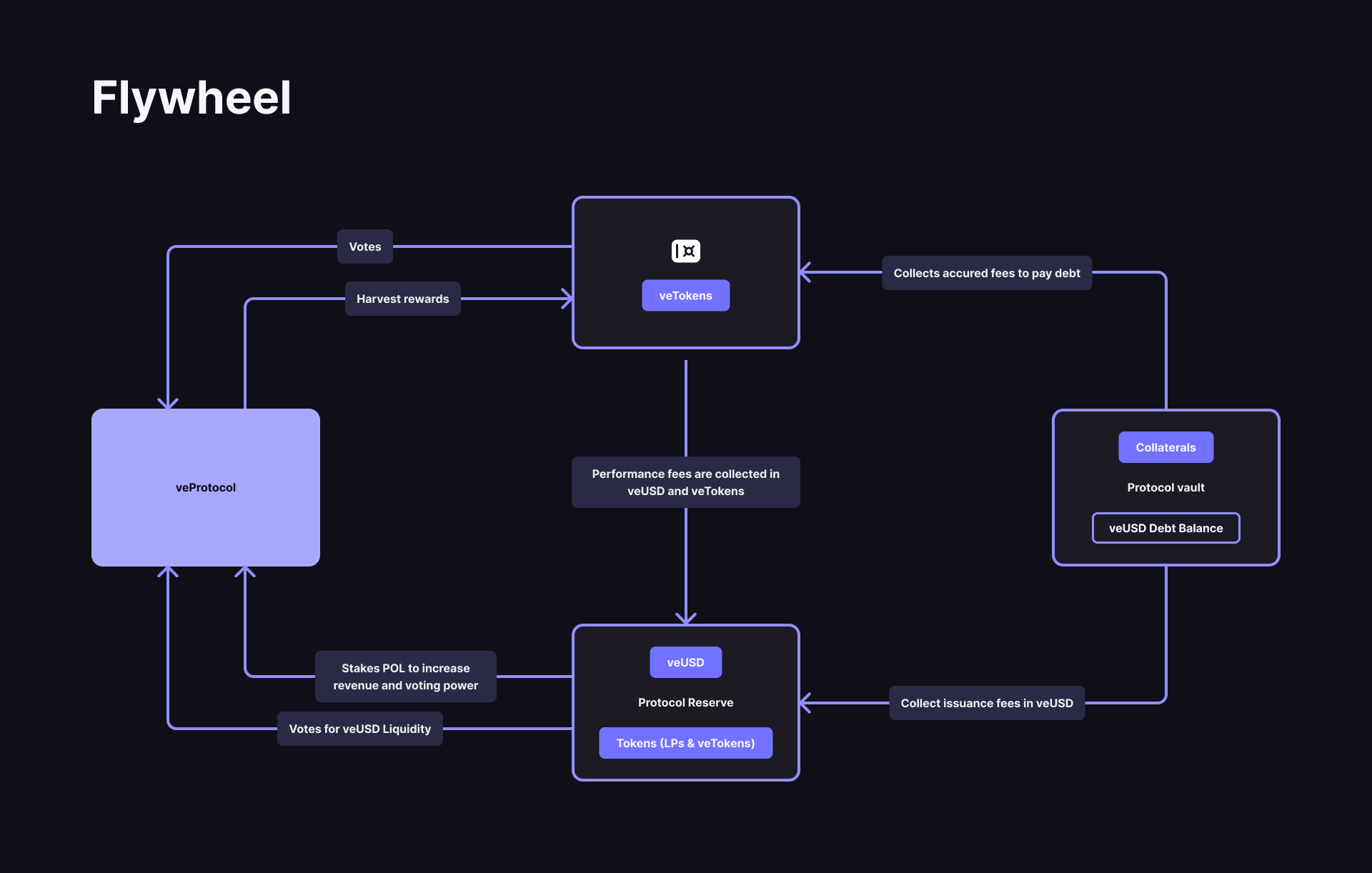

The flywheel

Accelerating success

As Vaultedge will count with a big amount of veTokens in the collateral vaults, the protocol will implement strategies that will serve 2 specific functions:

Propel USDVE liquidity on Dexes, to ensure deep liquidity pools by voting toward USDVE pairs. Leveraging on the ve(3,3) Dexes, Vaultedge will drive rewards to USDVE farms.

Maximizing rewards harvested by the protocol. This approach addresses two crucial aspects of Vaultedge, repaying users' debt and growing the Vaultedge treasury. The implemented strategy will have a compounded effect, accelerating debt repayment and increasing protocol revenue through a 15% management fee on the yield.

Last updated