Maintaining the peg

Arbitrage oportunities

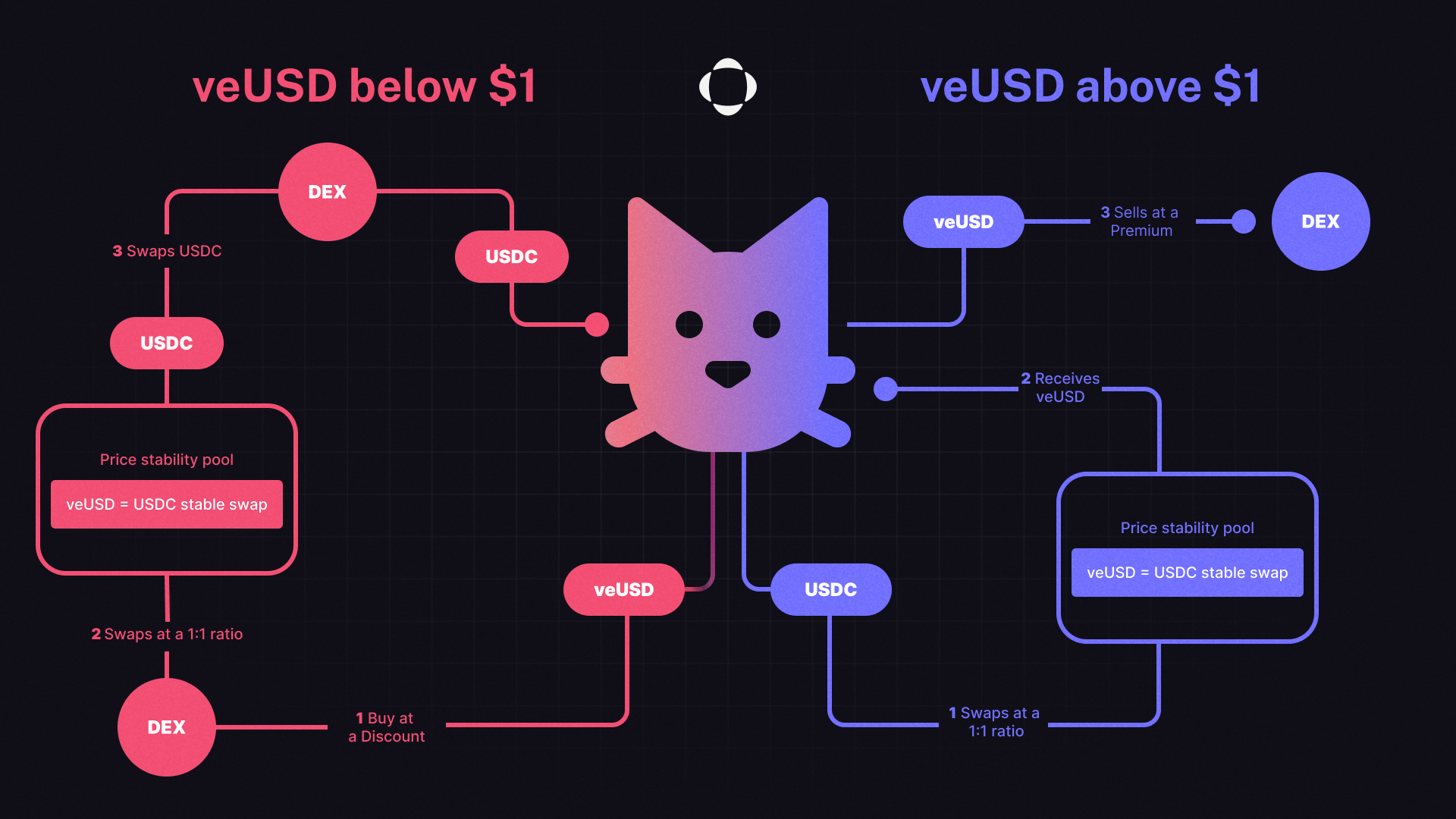

In case of de-pegging, USDVE has two mechanisms to restore the peg. Depending on whether the peg is lost to the upside or downside, users can profit from this situation through arbitrage opportunities.

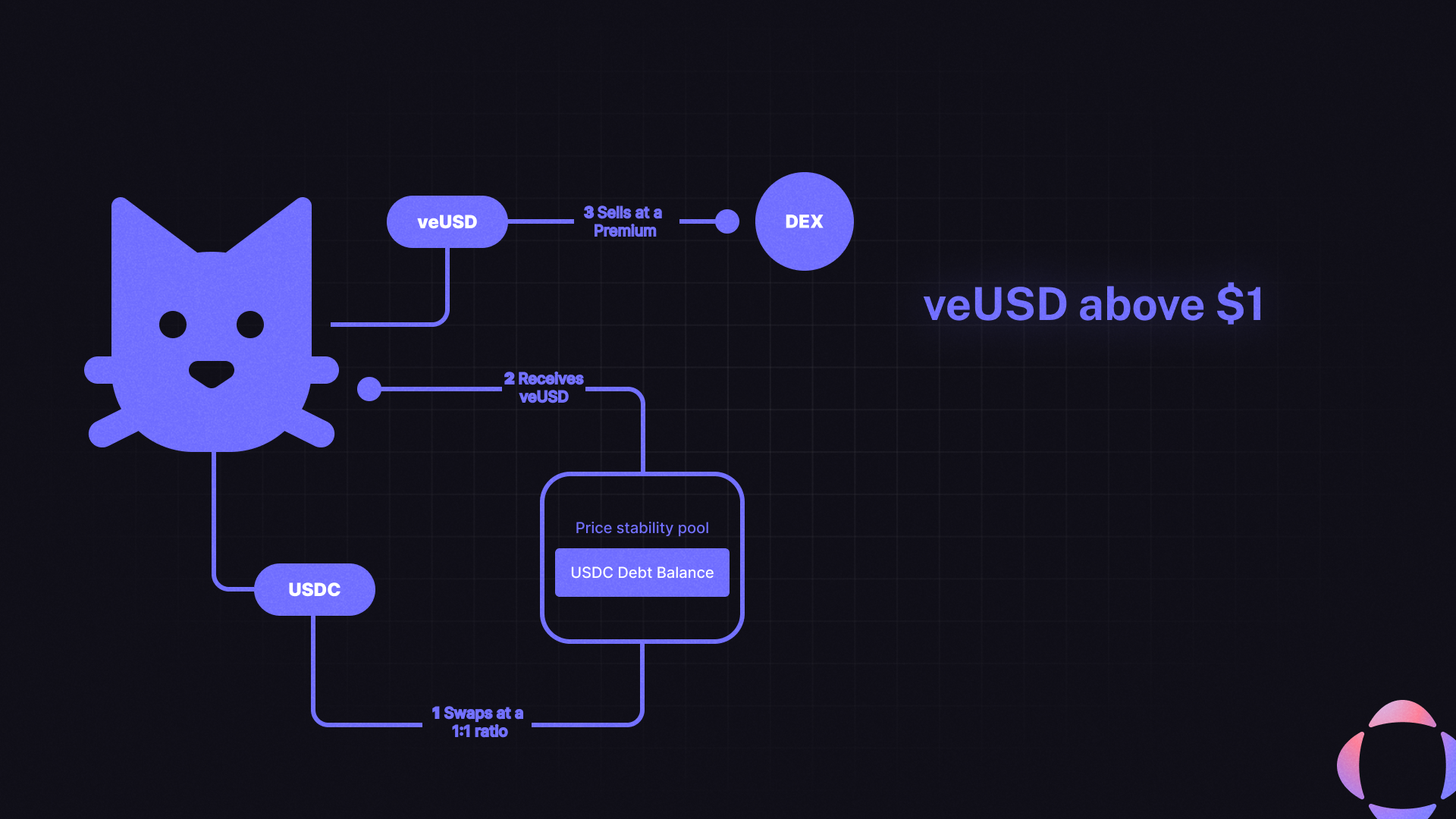

USDVE Above $1: In this scenario, users can mint USDVE at a 1:1 ratio with stablecoins (such as USDC/USDT) and sell the USDVE on a DEX. For example, if 1 USDVE = $1.10 USDT, a user can deposit an equivalent amount of USDT on Vaultedge to mint the same amount of USDVE at a 1:1 ratio. The user can then sell the USDVE on a DEX for a 10% profit in USDT and use the USDT to repay the debt.

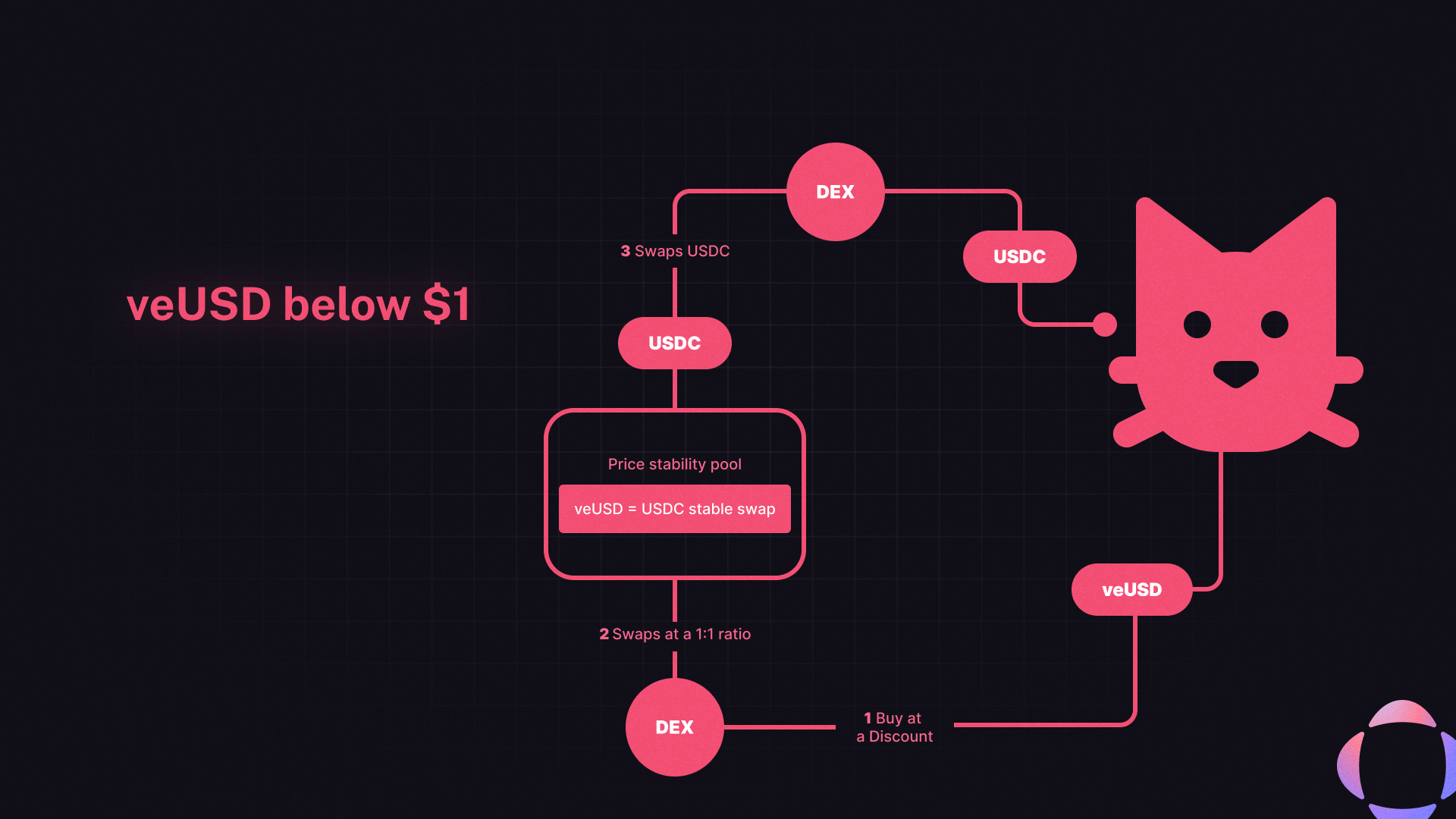

USDVE Below $1: In the event of USDVE de-pegging, users can buy USDVE at a discount on the open market (DEX) and then redeems collateral from the protocol vault at a higher price, resulting in a profit. When a user performs arbitrage following this mechanism, the USDVE is burned, reducing the supply and helping to bring USDVE back to its peg.

Last updated